Efficiently Managing your Most Important Source of Investor Intelligence

Published on May 26, 2018

Everyone, irrespective of their industry or role wants to be fully prepared for meetings to ensure they are a valuable use of all the participants time. This is especially true of Investor Relations teams who are often managing one of their company’s most important resources - senior management’s time.

For IR teams, being fully prepared for investor meetings typically means having all the details from prior meetings, answers to any questions that have been previously raised and an overall understanding of what the investor cares about. Shareholding data and generic investor profiles sourced from vendors only go a small part of the way to providing what is needed to maximize the value of a meeting - real investor intelligence comes from the notes that IR teams diligently create after each meeting and build up over a number of years.

This is the database that informs IR teams of the key concerns an investor has about the company and the triggers for them to increase their shareholding - intelligence that can only be obtained after 1x1 meetings or calls with investors. Yet, despite the importance of these notes, from speaking with IRO’s it is clear that too much time is being spent in existing systems trying to manage this information and valuable insights are being lost due to the difficulty in extracting key details from the mass of information.

Adding a meeting note function is one of the most popular feature requests we get from our users which tells us that existing solutions for managing this process are not delivering the value that IR teams need. Armed with this feedback, we have been working with IRO’s to build something that improves the way notes can be used, ensures key insights are immediately accessible and brings efficiency to the whole process.

We will be releasing three features in the coming months that will deliver a simple solution for taking and using notes intelligently and help IR teams to fully maximize the value of the investor intelligence they collate.

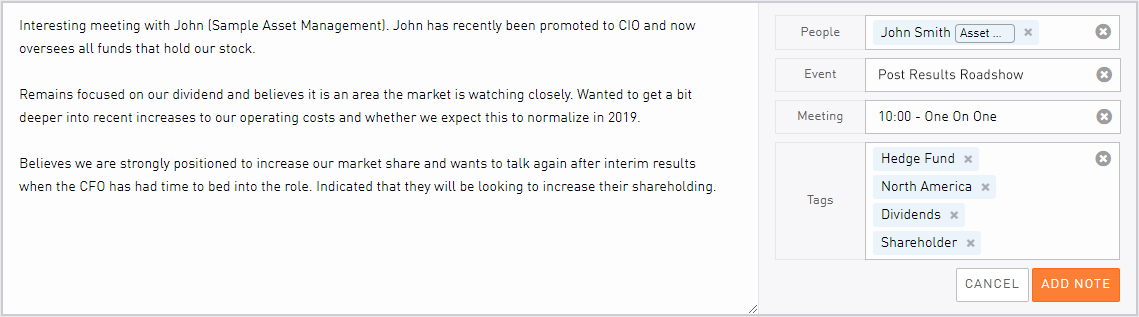

Create notes

When creating a note, every dimension is automatically stored against the note (event, meeting type, location, date and time, meeting participants, who created the note and when etc.) with the added option to add relevant tags - Enabling powerful search and providing the tools to always find the information you need.

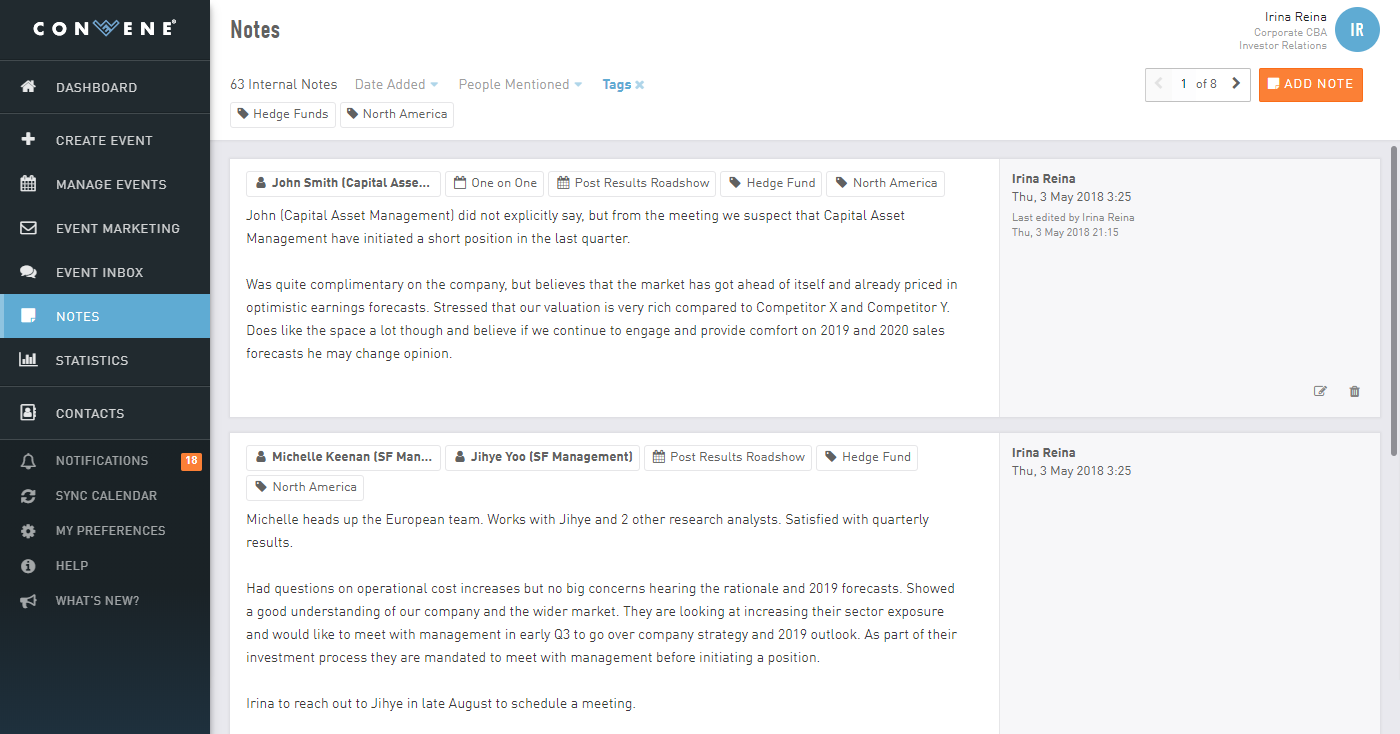

Manage Notes

IR teams can filter their complete database of investor intelligence by any criteria to pull out individual or groups of notes to find common themes. Want to view all notes related to Hedge Funds who are Shareholders and based in North America, or which investors have highlighted dividends as an area of interest - Key insights are at your fingertips.

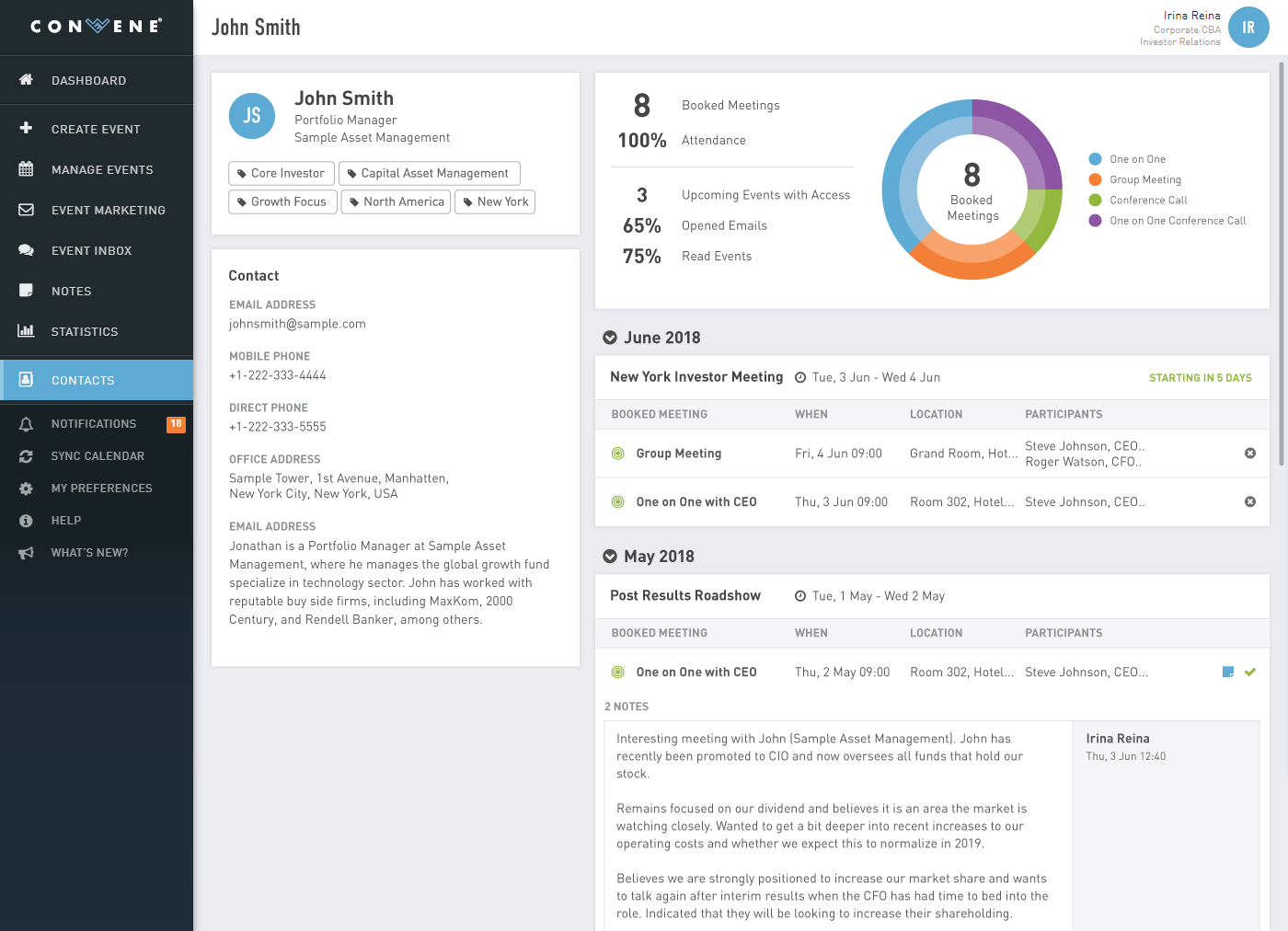

Individual Pages

WeConvene Individual Pages are your single repository of information on an investor with easy access to each investors contact information, biography, meeting history, calls, meeting invites sent and notes added - Every detail is automatically recorded and aggregated for a complete investor profile, accessible in a single click.

About WeConvene

Established in 2012, WeConvene is the cloud-based meetings and events management and marketing platform that helps the capital markets community book better®. WeConvene makes the creation, distribution, marketing and execution of official meetings and events between analysts, corporates, investors, IR firms, expert networks and investment banks fast and easy, generating better outcomes including greater team efficiency, increased meeting attendance and enhanced client satisfaction. For more information please visit WeConvene.com. For a demo or sales introduction please click here to request now.